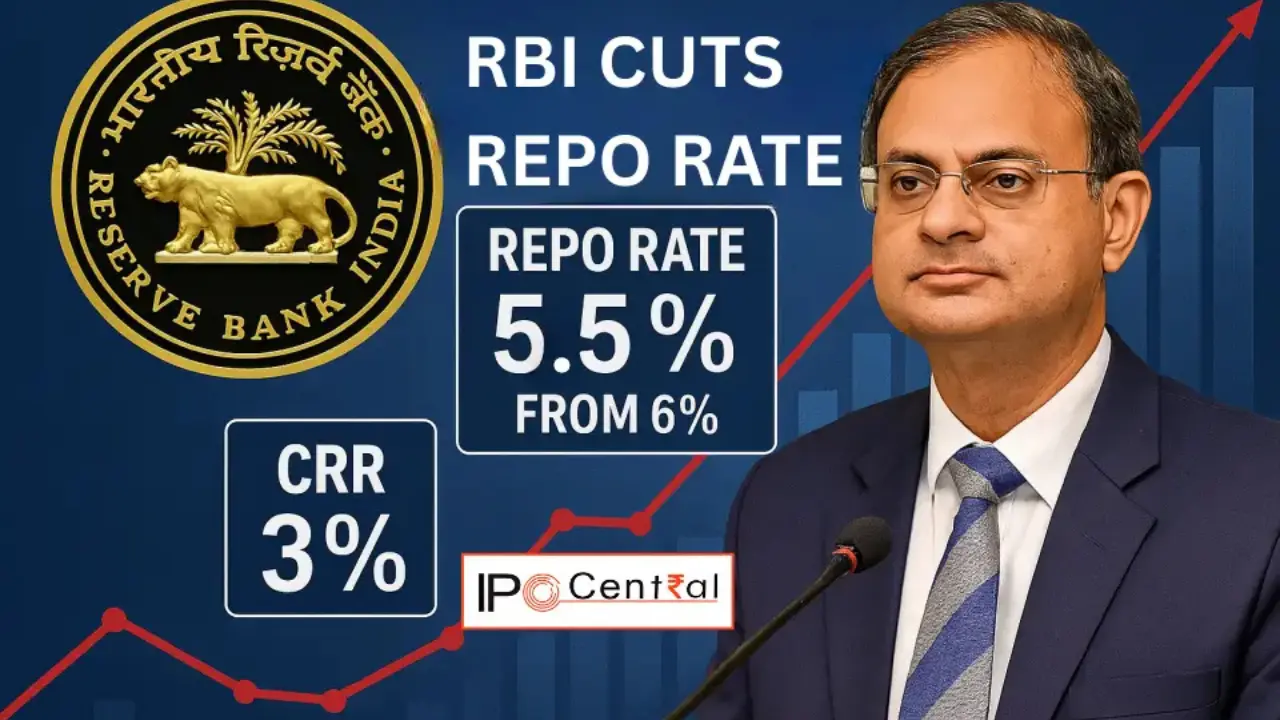

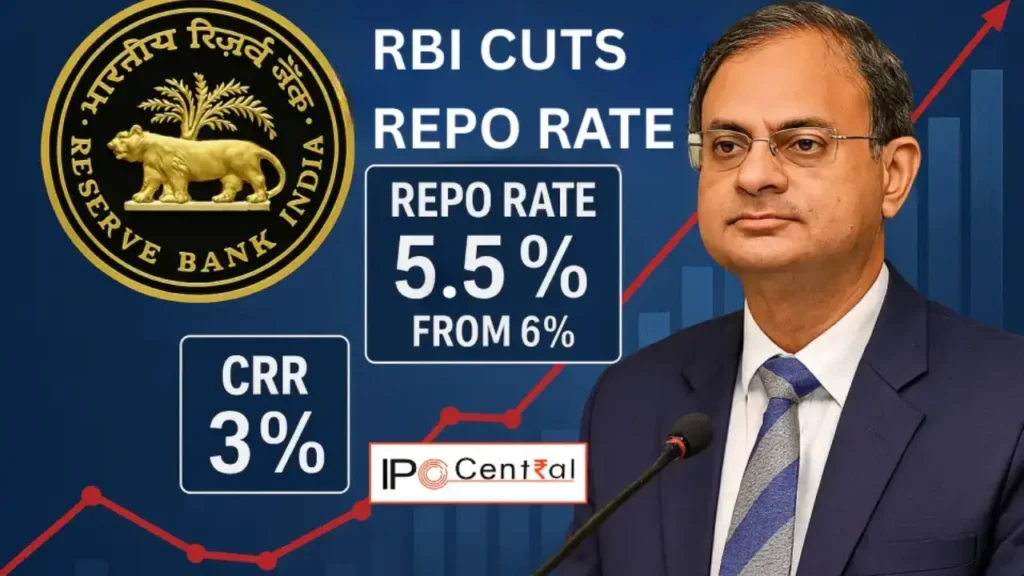

Key Highlights of the RBI’s June 2025 Policy Decision

1. Repo Rate Cut to 5.50%

The repo rate, the rate at which the RBI lends to commercial banks, was reduced by 50 basis points to 5.50%. This move aims to stimulate economic growth by making borrowing cheaper for businesses and consumers.

2. CRR Reduced to 3%

The Cash Reserve Ratio, the percentage of a bank’s total deposits that must be maintained with the RBI, was cut by 100 basis points to 3%. This reduction is expected to enhance liquidity in the banking system, enabling banks to lend more to the productive sectors of the economy.

3. Policy Stance Shifted to ‘Neutral’

The RBI changed its policy stance from “accommodative” to “neutral,” indicating a more balanced approach to future rate decisions, dependent on evolving economic indicators.

Economic Indicators Influencing the Decision

1. Inflation Trends

Consumer Price Index (CPI) inflation has been on a downward trajectory, with the RBI projecting inflation at 3.7% for FY26, down from the earlier estimate of 4%. This decline in inflation provided the RBI with room to cut rates to support growth.

2. GDP Growth Outlook

The RBI maintained its GDP growth forecast for the current fiscal year at 6.5%, acknowledging potential headwinds from global geopolitical tensions and domestic factors.

Impact on Financial Markets and Borrowers

1. Banking Sector Response

Following the rate cut, banking and non-banking financial company (NBFC) stocks experienced positive momentum, with the Nifty Bank index reaching a record high of 56,238.10. This reflects investor optimism about improved credit growth prospects.

2. Effect on Loan EMIs

The reduction in the repo rate is expected to lead to lower lending rates, resulting in decreased EMIs for borrowers. For instance, a ₹50 lakh home loan over 20 years could see a monthly EMI reduction of approximately ₹1,960.

3. Fixed Deposit Returns

While borrowers benefit from lower interest rates, fixed deposit (FD) investors may face declining returns as banks adjust FD rates downward in response to the repo rate cut. Senior citizens and conservative investors are advised to lock in current FD rates before further reductions occur.

Sectoral Implications

1. Real Estate

The rate cut is anticipated to boost the real estate sector by making home loans more affordable, potentially increasing housing demand.

2. Infrastructure and Manufacturing

Lower borrowing costs can stimulate investment in infrastructure and manufacturing, sectors crucial for economic growth and employment generation.

Future Outlook

The RBI’s shift to a “neutral” policy stance suggests a cautious approach to future rate decisions, with a focus on monitoring economic data and global developments. Further rate cuts will depend on the trajectory of inflation, growth indicators, and external factors.

Conclusion

The RBI’s decision to cut the repo rate to 5.50% and reduce the CRR to 3% underscores its commitment to supporting economic growth amid easing inflation. While borrowers stand to benefit from lower EMIs, investors should reassess their fixed-income strategies in light of potential declines in deposit rates. The central bank’s balanced approach aims to foster a conducive environment for sustainable economic recovery.

Disclaimer

The content published on this website is for informational and educational purposes only and does not constitute financial, investment, or legal advice. While we strive to provide accurate and up-to-date information, we make no guarantees regarding the completeness, reliability, or suitability of the content. Readers are advised to conduct their own research or consult a qualified financial advisor before making any investment or financial decisions. The website, its authors, and affiliates shall not be held liable for any loss or damage arising from reliance on information provided. Use of this website is at your own risk.